how much is inheritance tax in nc

Gifts of less than 16000 per year per individual are not taxed. With a tax-free threshold of 335000 per child and average house prices of about.

The estate tax is paid based on the.

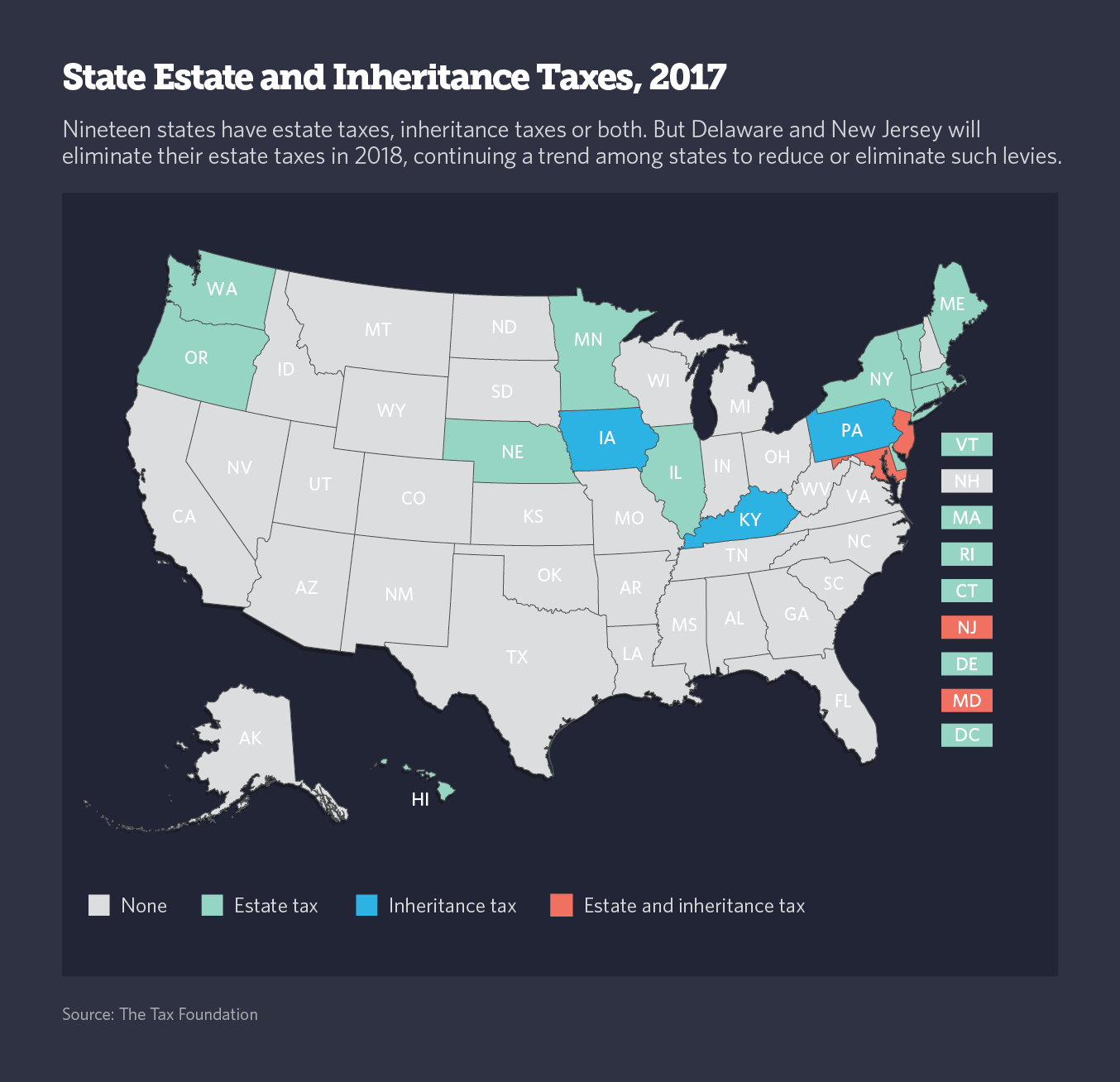

. Is there a federal inheritance tax 2020. The federal government does not impose an inheritance tax so the recent tax changes from the Trump administration did not affect the inheritance taxes imposed by the states. The major difference between estate tax and inheritance tax is who pays the tax.

After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the. However there are sometimes taxes. Estate tax is the amount thats taken out of someones estate upon their death.

North Carolina doesnt collect inheritance or estate taxes. For 2022 the annual exclusion is 16000. However state residents should keep federal estate taxes in mind if their estate or the estate they are inheriting is worth.

However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million. If you are planning your estate you can also pay for certain non. However the states top inheritance tax rate 10 percent is the lowest of any of the six states and children spouses parents grandparents stepchildren stepparents siblings.

What is the North Carolina estate tax exemption for 2021. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. The tax rate on cumulative lifetime gifts in excess of the.

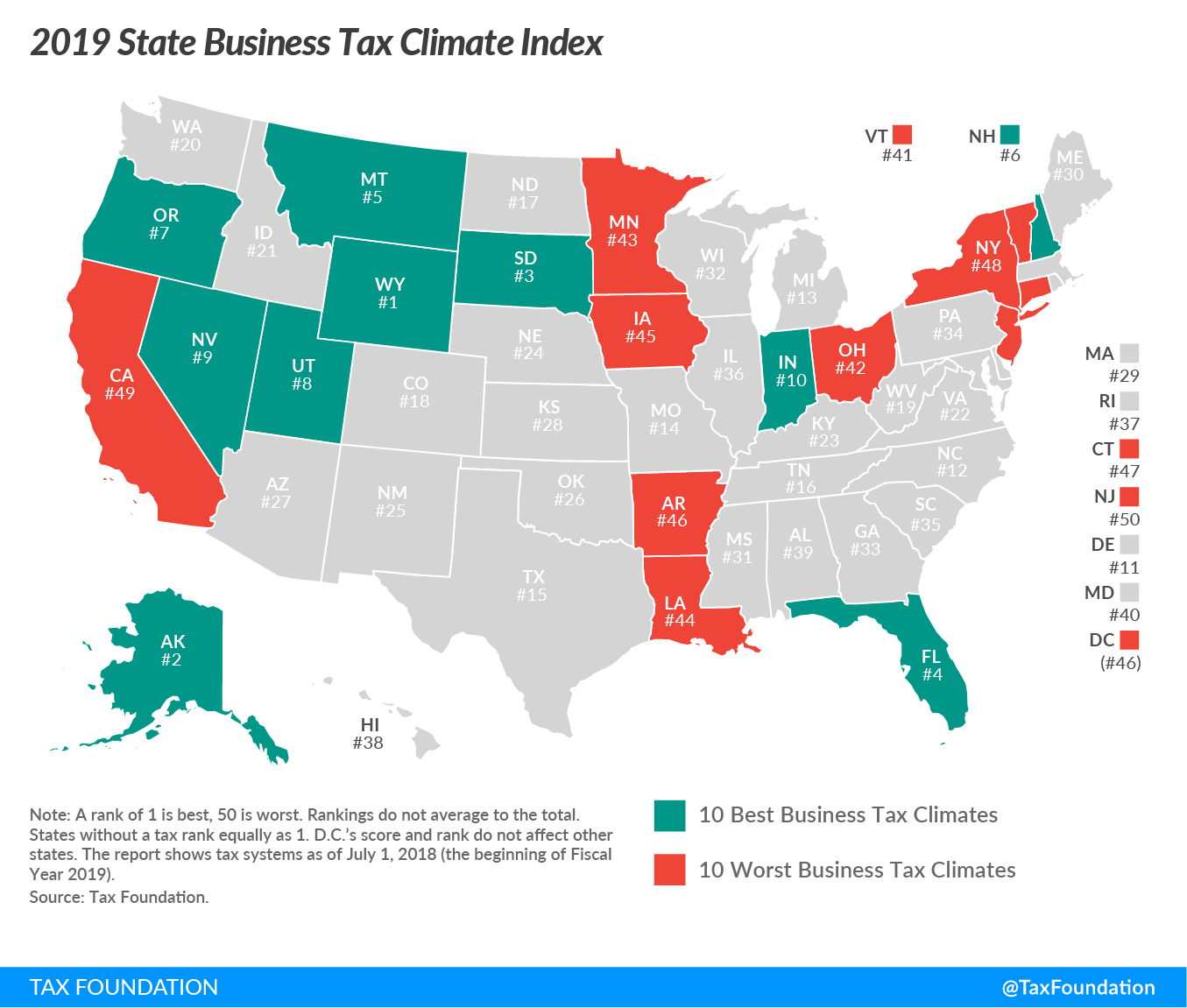

Its primarily a Dublin issue. NC has no Estate Tax Other States Still Have the Death Tax Also called the Death Tax this tax was repealed in 2013. How much property can you inherit without paying taxes.

How Much Is the Inheritance Tax. One both or neither could be a factor when someone dies. As previously mentioned the amount you owe depends on your relationship to the deceased.

The tax rate on. If you were the decedents parent grandparent sibling child other lineal descendant or the spouse of one of those people the first 40000 you inherit is exempt but. In 2021 federal estate tax generally applies to assets over 117.

The current exemption amount for the Federal Estate Tax is 117 million per individual for the year 2021. How much money can you inherit without paying. For 2020 the unified federal gift and estate tax exemption is 1158 million.

The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to. Inheritance tax is imposed on the assets inherited from a deceased person. Some states and a handful of federal governments around the world levy this tax.

The estate tax is a tax on a persons assets after death. An inheritance tax is usually paid by a person inheriting an estate. There is no federal inheritance tax but there is a.

How Much Is the Inheritance Tax. Inheritance tax rates vary widely. What is the federal inheritance tax rate for 2021.

While there isnt an estate tax in North Carolina the federal estate tax may still apply. Heres a breakdown of each states inheritance tax rate ranges. For the year 2016 the lifetime exemption amount is 545 million.

Is Inheritance Taxable In California California Trust Estate Probate Litigation

How Every State Taxes Differently In Retirement Cardinal Guide

North Carolina Health Legal And End Of Life Resources Everplans

Tax Comparison North Carolina Verses South Carolina

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Inheritance Tax Archives Nc Policy Watch

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina State Taxes Everything You Need To Know Gobankingrates

Understanding North Carolina Inheritance Law Probate Advance

What Is Inheritance Tax Probate Advance

Understanding North Carolina Inheritance Law Probate Advance

State By State Estate And Inheritance Tax Rates Everplans

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Jump To First Page 1 Unit 8 Part 2 Estate Planning For Agriculture Forestry Basic Documents Tax Issues And Conservation Easements An Educational Ppt Download

A Guide To North Carolina Inheritance Laws

In States The Estate Tax Nears Extinction The Pew Charitable Trusts

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die